As of 2024, FinCEN (Financial Crimes Enforcement Network) is requiring entities such as C-Corps, S-Corps, and LLCs to identify their beneficial owners to the government on a rolling basis, factored from the date of their registration.

This requirement stems from the Corporate Transparency Act, which Congress passed in 2021. This is part of the U.S. Government's efforts to make it harder for bad actors to hide or benefit from their ill-gotten gains through shell companies or other opaque ownership structures.

You can bet that the IRS will be using this data in their enforcement and collection efforts as well.

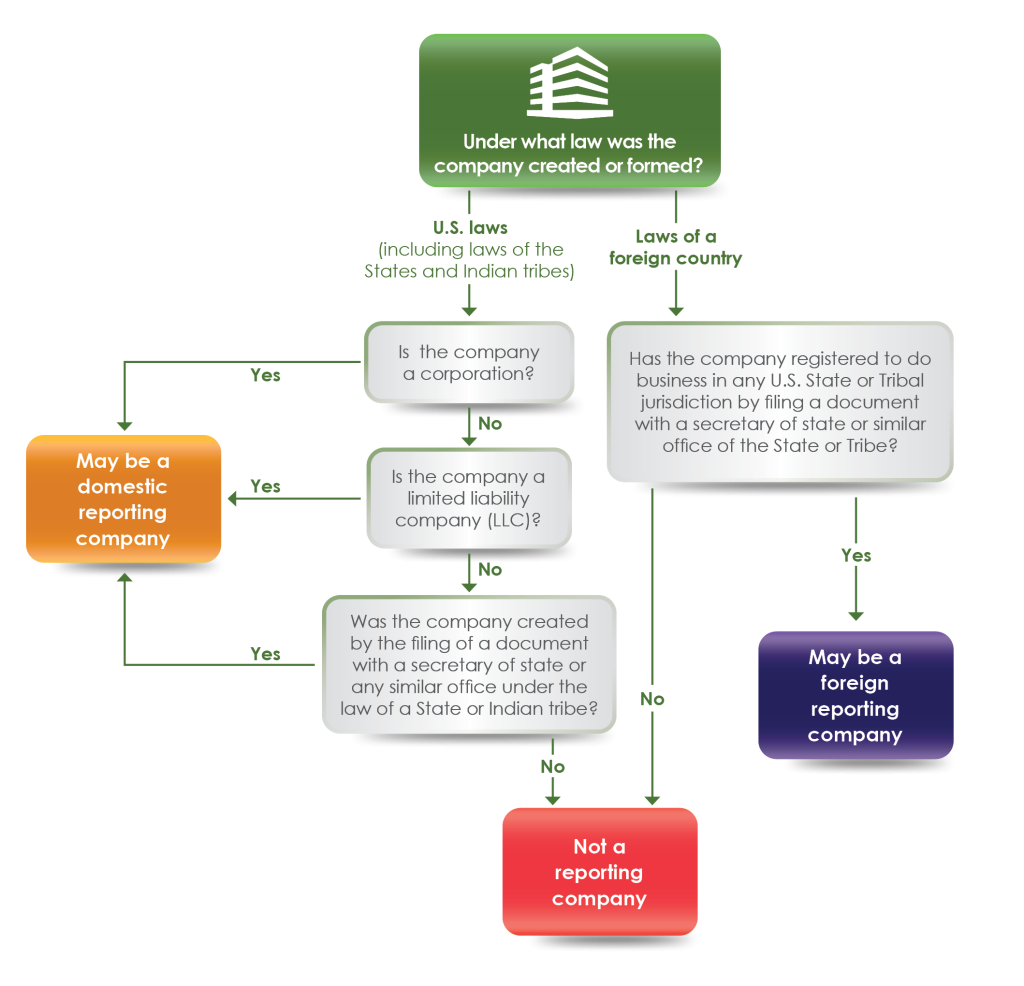

The first thing to learn is whether your company is required to report this information. Most likely, you will be required to report. There are 23 types of entities that are exempt from reporting. The chart below may help you determine whether your company is exempt:

As you can see, unless you are a sole proprietorship or general partnership, you likely will be required to provide this information. Exemptions exist for the following types of business whose other state and/or federal registration requirements already have put ownership information on file:

| Exemption No. | Exemption Short Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

Some states are popular for corporate and LLC registration, because they offer ownership privacy. This measure partially defeats that privacy protection.

Access to the Beneficial Ownership Information (BOI) you provide will be limited to Federal, State, local, and Tribal officials, as well as certain foreign officials who submit a request through a U.S. Federal government agency, to obtain beneficial ownership information for authorized activities related to national security, intelligence, and law enforcement.

Financial institutions will have access to BOI in certain circumstances, with the consent of the reporting company. Those financial institutions' regulators will also have access to BOI when they supervise the financial institutions.

If your company was established before January 1, 2024, you have until January 1, 2025, to make your mandated report. If you form a new company, you must report within 90 calendar days of receipt of confirmation that the new company registration is effective.

You can find more information on BOI by visiting the FinCEN's website.