We are being a little cheeky with the graphic. A ROBS Plan has nothing to do with being the victim or perpetrator of a robbery, at least by design. A ROBS Plan is a way to use accumulated retirement funds to capitalize your new business venture.

Whether this is a good or bad idea for you is the question we hope to assist you in answering today. Note that ROBS does not mean that you are robbing your retirement account, but it is possible that this could be the end result, if your venture ends poorly.

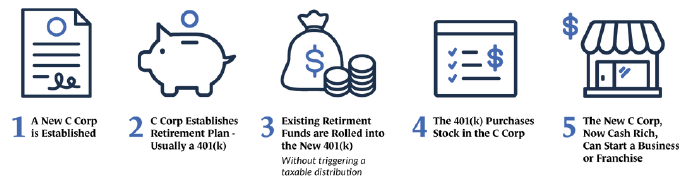

ROBS is an acronym (yes, this is a program from the government) for ROllover Business Startup. Now, being able to take money from your retirement account to capitalize your business sounds like a great idea, and conceptually, we would agree.

However, this program definitely comes with some major strings. Firstly, you must have an administrator to oversee your plan. The set-up costs alone can run from $5k to $8k, plus monthly administrative fees of about $150, so this program is not for the typical bootstrap individual.

You will also need to set-up your company as a C-Corp, which opens the double-taxation monster, while having its own added costs for set-up, administration, legal, and yearly tax preparation. You will need to pay yourself as an employee of the business and issue yourself a W-2 for your salary.

For a start-up business, cash flow could make this difficult. As a sole-prop, you can easily forego salary if necessary, but under a C-Corp, your paycheck is subject to the same requirements as any other employee's payroll. You can't just skip paying yourself if the business is running low on cash, and you can't vary your salary from payroll-to-payroll based on cash flow, either. Federal and State tax deposits must also be made timely, but that applies to all business structures.

Your plan administrator will be responsible for filing Form 5500 (applies to retirement plans) each year. You need to ensure that this gets done, as the responsibility for this rests upon your shoulders. However, you MUST have an administrator for your plan. You are not allowed to do this on your own.

Your C-Corp will pay corporate tax on profits, which rate is currently a flat 21% from the first dollar of profit. Bear in mind that the corporate tax rate may increase at the whim of the Federal Government, so vote carefully.

Your dividends will also be taxable at your regular tax rate (0% to 37% federal, plus state of 0% to as much as 14.4% for our friends in California).

Exiting a ROBS structure at a future date is possible, but you will definitely need the help of a solid accountant who is familiar with these programs to guide you. Yes, that will cost more money.

So far, this has all sounded like bad news. Does an upside or viable reason to use a ROBS Plan exist?

Well, it can work in the right situation. The money can be used for start-ups or to purchase an existing business. You can even use the money to purchase a franchise business, which can offer a proven platform on which to run.

Your retirement funds provide a tax-free, penalty-free way to access capital without borrowing. Starting your business without extra debt can help you achieve profitability faster. You can combine your ROBS investment with an SBA loan in order to get property or equipment that your business needs.

There are some restrictions on the types of investments that can be made from a ROBS Plan. Your business cannot loan to, or borrow from, a shareholder. No shareholder can be inactive or absentee in the business. The business cannot own rental property or earn oil royalties or have any other passive investments.

If you want to buy a business and have your son or daughter operate it, while not being personally active in the business, this is not allowed. For a husband and wife who are both contributing from their personal retirement plans through a ROBS Plan, BOTH must be active in the business!

The only ways to take money from the business are via payroll and dividends, both of which are going to be taxable. Your CPA or tax adviser can give you more guidance on the tax implications here.

Keep in mind that dividends must be paid based on ownership. If your ROBS Plan owns 71% of your business, then 71% of all dividends must be paid back to your retirement plan, and the other 29% would be taxable to you at your individual income tax rates. So, it is not just as simple as telling yourself that you need $10k from the business for other purposes and paying yourself a direct dividend for this amount.

Not all retirement plans qualify for ROBS, however. If you have a 401(k), 403(b), Traditional IRA, Keogh, TSP, or SEP, you are good-to-go. Be advised that ROBS cannot be used with a Roth IRA.

Even though you are investing money from your retirement plan into your business, you may still contribute to your retirement plan from your regular income. In fact, your new business is REQUIRED to set-up its own 401(k) plan for you and any employees. You may contribute up to 100% of your salary to your new 401(k) plan, subject to your annual contribution limit.

You might be wondering how a ROBS Plan differs from a Self-Directed IRA (SDIRA). The biggest difference is that a ROBS Plan requires you to be active in the business, while an SDIRA forbids you (or any prohibited person, such as an immediate family member) from having any role in the business.

A ROBS Plan can provide capital for you to start-up or purchase a business or franchise where you may not be able to find the money anywhere else. Due to the cost structure, a ROBS Plan for less than $300k to $400k is usually not cost-effective. If this is the only way you can get the capital you need, then it may be the right option for you.

Before moving forward, be sure to interview several potential plan administrators and speak to your CPA to ensure that your plan is properly established and meets the legal requirements of the IRS. One of the biggest and most-respected plan administrators is Guidant Financial. See their link below for more information on ROBS Plans.