Not every commercial transaction requires an appraisal, but most applications will. Appraising commercial properties involves a detailed process to determine market value, which directly influences loan approval and terms. Here’s a breakdown of how commercial properties are appraised and how the valuation impacts loan approval:

Appraisal Methods for Commercial Properties

Income Approach:

-

-

- Overview: This method values the property based on its income-producing potential. It is commonly used for income-generating properties such as office buildings, retail centers, and multifamily apartments.

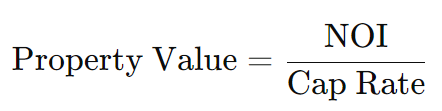

- Process: The appraiser estimates the property’s Net Operating Income (NOI) by analyzing current and projected rental income and subtracting operating expenses. The NOI is then divided by a capitalization rate (cap rate) to determine the property’s value.

- Cap Rate Calculation: The cap rate is derived from recent sales of comparable properties and reflects the rate of return expected by investors. Cap rates will vary by market area, usually due to the expected increase in value versus market rents. The formula is: <style="text-align: center;"="">

-

-

- </style="text-align:>

Sales Comparison Approach:

-

- Overview: This method compares the subject property to similar properties that have recently sold in the market. It is widely used for properties with active sales data, such as retail spaces or office buildings.

- Process: The appraiser adjusts the sale prices of comparable properties to account for differences in features, size, location, and condition. The adjusted sale prices are used to estimate the value of the subject property.

Cost Approach:

-

- Overview: This method estimates the value of the property based on the cost to replace or reproduce it, minus depreciation. It is often used for unique or newly constructed properties where sales data or income data may be limited.

- Process: The appraiser calculates the cost to build a similar property at current prices, subtracts depreciation, and adds the value of the land to determine the property’s value.

Combination Approach:

-

- Overview: In practice, appraisers often use a combination of the above methods to provide a more comprehensive valuation. The weight given to each approach depends on the property type and available data.

Factors Influencing Property Valuation

Location:

-

- Market Demand: High-demand areas typically lead to higher property values. Factors include proximity to amenities, accessibility, and neighborhood trends.

- Economic Conditions: The local economy and job market impact property values. Strong economic conditions generally support higher values.

Property Condition:

-

- Physical Condition: The age, maintenance, and condition of the property affect its value. Well-maintained properties usually have higher values.

- Upgrades and Renovations: Recent improvements or renovations can enhance property value.

Income Potential:

-

- Rental Income: The amount of rental income the property generates is a key factor. Higher income potential usually leads to a higher valuation.

- Occupancy Rates: High occupancy rates and stable, long-term leases positively impact the property’s value.

Comparable Sales:

-

- Market Comparisons: Recent sales of similar properties in the area provide benchmarks for valuation. Differences in features and conditions are adjusted for in the appraisal process.

Impact of Valuation on Loan Approval

Loan-to-Value (LTV) Ratio:

-

- Definition: The LTV ratio is the loan amount divided by the property’s appraised value. It is a critical metric for lenders.

- Impact: A higher LTV ratio represents higher risk for lenders, potentially leading to higher interest rates or more stringent loan terms. A lower LTV ratio is generally preferred, as it indicates lower risk.

Loan Amount:

-

- Approval Limits: The appraised value determines the maximum loan amount a lender is willing to provide. Lenders usually cap the loan amount based on the property’s appraised value and their lending guidelines.

Interest Rates and Terms:

-

- Rate Impact: A higher property valuation can support more favorable loan terms and interest rates, as it implies a lower risk for the lender.

- Term Considerations: Lenders may offer longer loan terms for properties with higher valuations, reflecting the lower risk and stronger financial position.

Risk Assessment:

-

- Risk Evaluation: A lower appraised value relative to the loan amount increases the risk for lenders. This may result in a higher risk premium, stricter loan conditions, or a denial of the loan.

- Financial Cushion: An accurate and favorable appraisal provides a financial cushion, ensuring that the property can cover the loan amount in case of default.

Challenges and Considerations

Appraisal Discrepancies:

-

- Differences in Valuation: Discrepancies between the appraised value and the purchase price or borrower’s expectations can impact loan approval and negotiations.

Revaluation Requests:

-

- Reappraisal: If the appraisal comes in lower than expected, borrowers may request a reappraisal or negotiate the purchase price or loan terms.

Market Volatility:

-

- Economic Shifts: Changes in the real estate market or economic conditions can affect property valuations and, consequently, loan approvals.

Conclusion

The appraisal process for commercial properties involves evaluating income potential, market comparisons, and property condition. The resulting valuation directly impacts loan approval, influencing the loan amount, terms, and interest rates. Accurate property valuation is crucial for securing favorable loan conditions and managing financial risk effectively.