Commercial loan terms can vary widely depending on the lender, the type of property, the borrower's financial profile, and market conditions. At RPA Commercial Loans, before you ever see a term sheet, we negotiate with the funder/lender to obtain the best possible loan terms for you.

Keep in mind that the best interest rate doesn’t always indicate the best loan package. Other aspects, such as loan duration, prepayment penalties, and costs play an important part in deciding which is the best offer for you. We will help you to sort through multiple offers to determine which is the best fit for your situation.

There are several common terms and conditions that you are likely to encounter in commercial real estate financing. Here’s a comprehensive overview:

Loan Amount

Maximum and Minimum Loan Amounts:

-

- Commercial Loans: Generally have higher minimum loan amounts compared to residential loans. Our preferred minimum loan amount is $1 million, but we can entertain application from $100k and up, depending on case-by-case factors. The maximum loan amount can be influenced by the property’s value, the borrower’s creditworthiness, and the lender’s policies. We can provide individual and portfolio loans up to $10 billion+.

Interest Rate

Fixed vs. Variable Rates:

-

- Fixed Interest Rate: Remains constant over the life of the loan. Provides stability and predictability in monthly payments.

- Variable (Adjustable) Interest Rate: Fluctuates based on market conditions or an index (e.g., LIBOR or SOFR). Often starts lower than fixed rates but can change periodically.

Interest Rate Type:

-

- Prime Rate: Commonly used as a benchmark for variable rates.

- SOFR: The Standard Overnight Funds Rate is set by the Fed and used by some funders as a benchmark rate.

- Spread or Margin: The additional percentage added to the benchmark rate in variable-rate loans.

Loan Term

Duration:

-

- Short-Term Loans: Typically 1 to 5 years. Often used for short-term financing needs or bridge loans.

- Medium-Term Loans: Generally 5 to 10 years. Suitable for longer-term investments but may require periodic refinancing.

- Long-Term Loans: 10 to 25 years or more. Common for large commercial mortgages and stable investments.

Amortization Period

Repayment Schedule:

-

- Full Amortization: The loan is paid off in full over the term with regular payments covering both principal and interest.

- Partial Amortization: The borrower makes payments that cover interest and a portion of the principal, but the loan balance may require a balloon payment at the end of the term.

Loan-to-Value (LTV) Ratio

Definition:

-

- LTV Ratio: The loan amount divided by the property’s appraised value or purchase price. It indicates the proportion of the property’s value being financed through the loan.

Typical LTV Ratios:

-

- Commercial Properties: Often range from 65% to 80%, depending on the type of property and the borrower’s profile.

- Multifamily Properties: Can also range from 65% to 80% and may vary based on specific property characteristics.

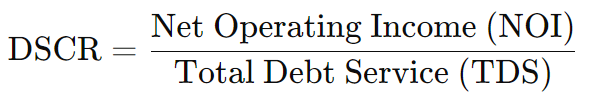

Debt Service Coverage Ratio (DSCR)

Definition:

-

- DSCR: A measure of the property’s ability to cover debt payments with its net operating income. Calculated as:

Typical Requirements:

-

- Commercial Properties: Lenders usually require a DSCR of 1.2 to 1.4. A higher DSCR indicates a lower risk for the lender. Some DSCR lenders will allow coverage as low as 0.90 with mitigating factors.

Prepayment Penalties

Definition:

-

- Prepayment Penalty: Fees charged if the borrower pays off the loan early. This compensates the lender for lost interest income. Prepayment options and schedules can vary widely, so discuss this with us to see what makes the most sense for you.

Types:

-

- Fixed Penalty: A set amount or percentage based on the remaining loan balance.

- Yield Maintenance: A calculation to ensure the lender receives the same yield as if the loan were held to maturity.

- Defeasance: Requiring the borrower to purchase securities to replace the loan’s cash flow. This is common with CMBS loans and should be weighed carefully against your future plans for the property.

Origination Fees

Definition:

-

- Fees: Charges by the lender for processing the loan application. Typically a percentage of the loan amount, ranging from 0.5% to 3%. Our standard origination fee is 2% for loans up to $20 million. Fees are negotiated on larger loans.

Loan Covenants

Definition:

-

- Covenants: Conditions and requirements that the borrower must adhere to during the life of the loan.

Types:

-

- Affirmative Covenants: Actions the borrower must take, such as maintaining insurance or providing regular financial statements.

- Negative Covenants: Restrictions on the borrower’s actions, such as prohibitions on additional debt or major property alterations.

Collateral

Definition:

-

- Collateral: The property itself serves as collateral for the loan. Lenders may also require additional security interests or personal guarantees.

Personal Guarantees

Definition:

-

- Guarantees: Personal or corporate guarantees may be required, especially for new or smaller businesses. This ensures the borrower or their principals are personally liable for the loan.

Recourse vs. Non-Recourse Loans

Recourse Loans:

-

- Definition: The borrower is personally liable for the loan beyond the collateral. If the property does not cover the loan, the lender can pursue other assets of the borrower.

Non-Recourse Loans:

-

- Definition: The lender’s only recourse in case of default is the collateral property itself. The borrower’s personal assets are protected.

Draw Schedule

Definition:

-

- Draw Schedule: For construction or renovation loans, a schedule outlining how and when the borrower can access loan funds based on project milestones.

Loan Closing Costs

Definition:

-

- Costs: Includes legal fees, title insurance, appraisal fees, and other expenses related to closing the loan. Typically, these are a one-time cost payable at the loan closing.

- Processing Fee: We charge a processing fee ranging from $2,500 to 0.10% of the loan amount. This fee is fully-earned and due at the time of acceptance of a term sheet and is paid along with the lender deposit for third-party fees.

Conclusion

Understanding commercial loan terms is essential for navigating the mortgage process effectively. Each term, from interest rates and loan amount to DSCR and prepayment penalties, influences the financial aspects of securing and managing a commercial mortgage. Familiarity with these terms helps borrowers make informed decisions, negotiate better terms, and ensure the loan aligns with their financial goals and property investment strategy.