The Debt Service Coverage Ratio (DSCR) is a critical metric in commercial real estate mortgage applications. It measures a property’s ability to generate enough income to cover its debt obligations. Here’s a comprehensive guide on understanding, calculating, and interpreting DSCR, and its importance in the mortgage application process:

Understanding DSCR

Definition:

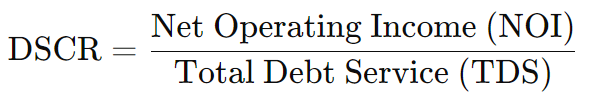

Debt Service Coverage Ratio (DSCR): DSCR is a financial ratio used to assess a property’s ability to cover its debt payments (principal and interest) with its net operating income (NOI). It is a key indicator of financial health and risk for lenders.

Formula:

- Net Operating Income (NOI): The income generated from the property after deducting operating expenses but before deducting interest and principal payments. It reflects the property's operational profitability.

- Total Debt Service (TDS): The total amount of debt payments required over a specific period, usually annually. This includes both interest and principal payments.

Calculating DSCR

Step-by-Step Calculation:

Determine Net Operating Income (NOI):

-

- Gross Rental Income: Total income from rents and other sources.

- Operating Expenses: Costs related to property management, maintenance, utilities, property taxes, and insurance.

Calculate Total Debt Service (TDS):

-

- Debt Service Payments: Sum of annual principal and interest payments on the mortgage.

Compute DSCR:

-

-

- Apply the DSCR formula:

-

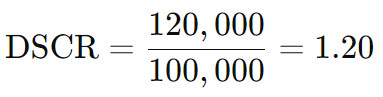

Example Calculation:

- NOI: $120,000

- Annual Debt Service: $100,000

DSCR Calculation:

Importance of DSCR in Mortgage Applications

Assessing Property’s Financial Health:

- Operational Efficiency: A high DSCR indicates that the property generates sufficient income to cover its debt obligations, reflecting strong operational efficiency and financial health.

Lender Risk Assessment:

- Risk Mitigation: Lenders use DSCR to evaluate the risk of lending. A higher DSCR suggests lower risk, as the property is more likely to generate enough income to meet debt payments. Conversely, a lower DSCR indicates higher risk and potential challenges in debt servicing.

Loan Approval and Terms:

- Approval Criteria: Lenders typically have minimum DSCR requirements. For commercial real estate loans, a DSCR of 1.2 to 1.4 is common. A ratio above this range is often favorable and can enhance the likelihood of loan approval.

- Interest Rates and Terms: A higher DSCR can lead to more favorable loan terms, including lower interest rates and better conditions. A lower DSCR may result in higher rates and stricter terms to compensate for the increased risk.

Financial Planning and Stability:

- Buffer for Unexpected Costs: A higher DSCR provides a financial buffer, ensuring that the property can handle unexpected expenses or fluctuations in income without jeopardizing debt service.

- Investment Viability: Investors use DSCR to gauge the viability and profitability of a property. A strong DSCR supports investment decisions and helps in assessing whether the property meets financial objectives.

Practical Considerations

Minimum Requirements:

- Industry Standards: Different lenders and types of properties may have varying DSCR requirements. Understanding the standard requirements for your specific loan type and lender is crucial.

Impact of Changes:

- Income Fluctuations: Changes in rental income or operating expenses can affect DSCR. Regular monitoring and adjustments to financial projections help maintain a favorable DSCR.

Long-Term Financial Planning:

- Sustainable Management: Maintaining a strong DSCR involves effective property management and financial planning. Ensure that income and expenses are carefully managed to sustain a healthy DSCR over the long term.

Conclusion

DSCR is a vital metric in commercial real estate mortgage applications, reflecting a property’s ability to cover its debt obligations with its operating income. Understanding and calculating DSCR involves assessing net operating income, total debt service, and using these figures to evaluate the property’s financial stability and risk. A strong DSCR is important for securing favorable loan terms, mitigating lender risk, and ensuring long-term financial stability and investment success.